Explained: The implications of tuition inflation on university students today

December 9, 2021

How much are you willing to pay for a college education?

Throughout history, the University of Wisconsin System and the University of Wisconsin-La Crosse have witnessed changes both at home on campus and through the UW System’s new legislation. Ultimately, one of the changes students often face is tuition increases. Though yearly single-digit percent increases in tuition seem rather insignificant, in the grand scheme of things single-digit increases eventually turn into double-digit level inflations and result in tuition rates similar to what we have now. Generally, tuition not only affects students attending school at UWL, but the entire UW System.

Though there was a time when students were able to finance college with a summer job and a winter gig, we are no longer living in those times. According to an article published by CNBC, they said, “A college education is now the second-largest expense an individual is likely to make in a lifetime — right after purchasing a home.”

In further comprehending the tuition disconnect, according to Foundations for Economic Education, “Since 1980 the cost of going to college has risen twice as fast as the cost of living, climbing 57 percent between 1981 and 1986.” Elements that have contributed to rising tuition prices throughout the world include “deep cuts in state funding for higher education …. [these cuts] have contributed to significant tuition increases and pushed more of the costs of college onto students.”

As for at home, the UW Board of Regents has the ability to set the entire UW System’s tuition. According to the University of Wisconsin Tuition – Informational Papers, “The Board of Regents of the University of Wisconsin System is delegated the authority to set tuition under s. 36.27 of the statutes. The statutes permit the Regents to set separate rates for state residents and nonresidents and also for different classes of students, extension courses, summer sessions, and special programs.”

Changes in tuition are only made possible under certain criteria. The Definition of Intuitional-Wide Differential Tuition details how the system goes about increasing tuition. According to the Definition of Intuitional-Wide Differential Tuition “Institution-wide differential tuition is defined as tuition that is added to the base tuition level set by the Board of Regents to supplement services and programming for students within that institution above and beyond existing activities supported by GPR and PR funding.”

Some of the stipulations of tuition increases include:

1.) The need to notify students prior to being submitted to the Board of Regents

2.) Stances from students about the increase, and the student association (if provided)

3.) Clearly stated purpose of the increase

4.) Approval of both the chancellor and the President of the UW System

5.) Decisions regarding spending are ultimately up to the chancellor of the UW System

In reference to the UW Tuition – Informational Papers, additional “factors that may be considered in setting tuition include: whether or not students are paying their fair share; how tuition levels compare to those of similar institutions in other states; and whether the amount of the state subsidy is consistent with the perceived priority of public education in the larger context of the state’s needs.“

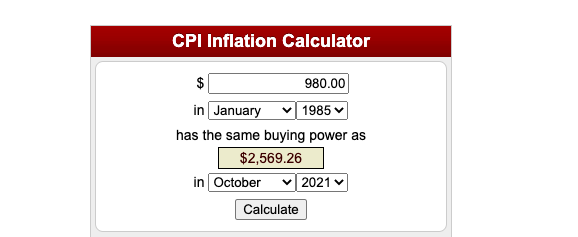

To give this information a historical context, according to the UW Tuition – Informational Papers, between the years 1984 to 1985 tuition cost $980 (today’s inflation equivalent of $2,569.26) at all comprehensive UW locations which include any UW extension besides Madison or Milwaukee or any two-year institutions. From there, tuition increased a minimum of three percent each year, with the highest percent increase being between 2003-04 and 2004-05 school years with it being 16.7 percent. The tuition reached $4,000 that year. In 2013 Governor Scott Walker signed the tuition freeze into law as a way to combat the backlash around the yearly tuition increases.

As of today, tuition at UWL costs $9,317. In May 2021, lawmakers voted to end the eight-year-long tuition freeze in order to allow “the UW System flexibility to develop talent, generate life-changing research and deliver the education students expect and families deserve,” said UW Chancellor Tommy Thompson. According to UW Tuition – Informational Papers, since 1985 tuition has increased approximately %850. Between the years 2004-05 tuition had cost $4,000. Since then, tuition prices have increased approximately %133 in the last 15 years alone.

According to Content Manager of Intelligent, Julia Morrissey, the change in expectations has been drastic. “To afford the average private-school tuition in 2020-2021 a student would have to work 100 hours per week at a minimum wage job, 52 weeks a year, compared to just 15 hours per week in 1970. To pay for the average public-school tuition a student would have to work 28 hours per week at minimum wage, 52 weeks a year, compared to only 5 hours per week in 1970.”

As a result of the increasing tuition, according to CNBC, “among the almost 70% of students who borrow for school, the typical senior now graduates with nearly $30,000 in debt.”

Though there are a variety of solutions for the student debt crisis in America, a primary solution rolling around the federal government right now, proposed by President Biden, is student debt forgiveness. Mark Mone, Chancellor at UW-Milwaukee commented on the idea of debt forgiveness and said he, “welcomes [the idea of] student debt forgiveness because the price of higher education places an immense burden on students and their families. But he said would have to see whether the funding to cover it would come from a viable source.”

In the interest of future generation, according to U.S. News, “Biden has said he supports up to $10,000 in student loan forgiveness per borrower … Biden announced in January that federal student loan payments would remain suspended and interest rates would be set at 0% through at least September, extending an action from former President Donald Trump.”